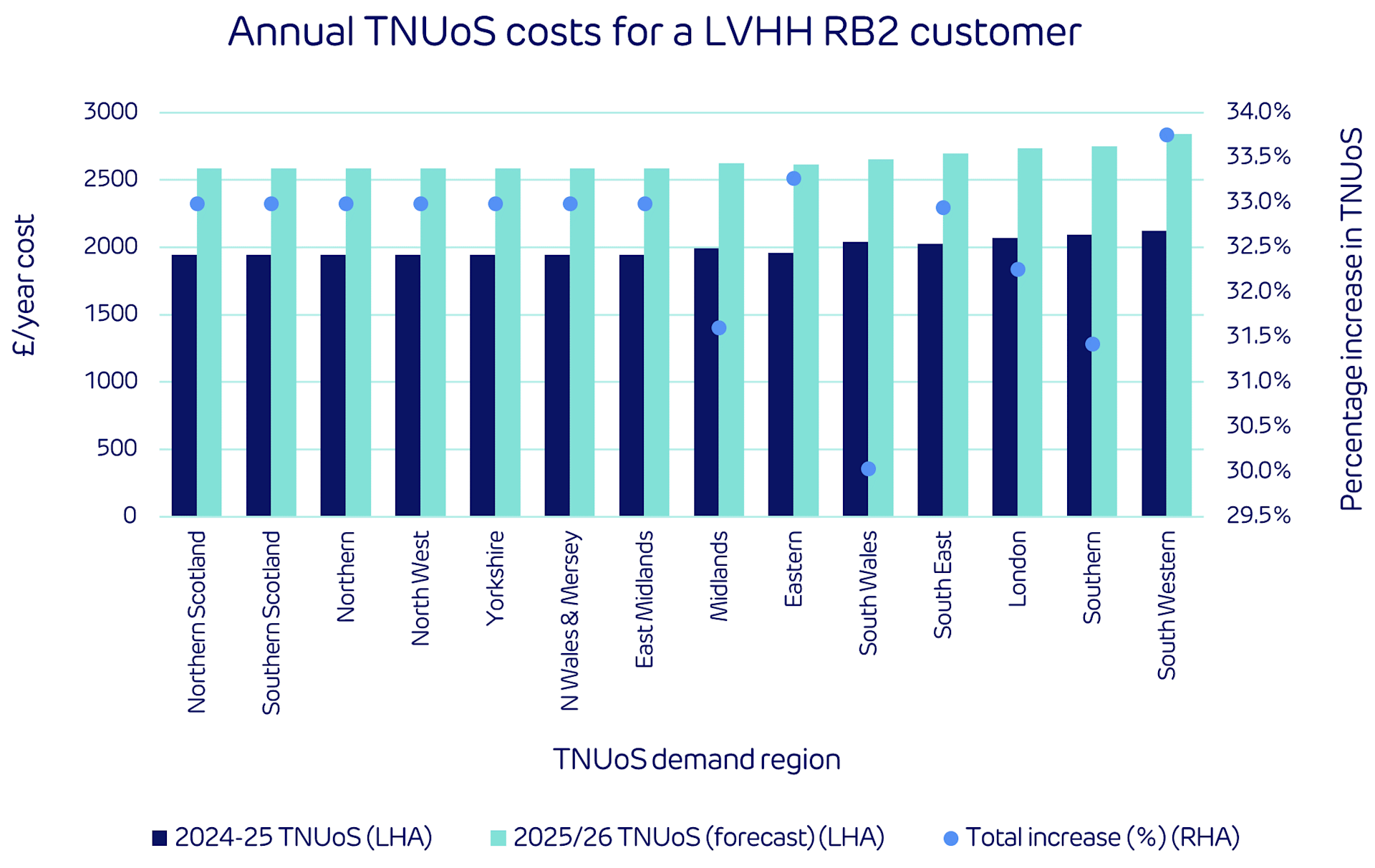

TNUoS charges forecast to rise over 30% from April 2025

Transmission network use of system (TNUoS) charges recover the cost of the installation and maintenance of the GB transmission network. National Grid Electricity System Operator (NGESO) published version 2 of its Five Year View of TNUoS charges on 13 May, predicting the tariffs for 2025-26 would increase as follows:

- 32% (£29.76/site/annum) for the average non-locational banded tariffs

(This is skewed by the number of domestic customers on the system – the average rise for all business consumers is 33% and the £/site/annum figure varies) - 19% (£1.26/kW) for the average locational half-hourly (HH) tariff

- 21% (£0.06p/kWh) for the average non half-hourly (NHH) locational tariff

The increase to the non-locational banded tariffs is due to a forecasted £1bn rise to the transmission demand residual revenues. This in turn is driven by greater TNUoS revenues to be recovered in the year.

Likewise, an increase in forecast zonal locational revenues is driving HH and NHH charges higher on average. Customers in the West Midlands and South Wales will see slightly lower locational HH charges based on the forecasts but still face greater TNUoS charges overall.

The graph below summarises the total Transmission Network Use of System (TNUoS) costs and year-on-year movements in TNUoS tariff for a typical Low-Voltage Site Specific Residual Band 2 customer (LVHH RB2).

Currently, the ESO forecasts TNUoS tariffs will increase much more slowly between 2025/26 and 2029/30:

- Average demand tariffs are predicted to rise 11% (£13.67 per site per annum) in total over the four year period

Our LVHH RB2 customer will see an increase of 14% (£366.48 per site per annum) on average between 2025-26 and 2029-30 - Average HH tariffs are forecast to fluctuate – falling in 2026/27 before rising to a 14% increase (£1.05/kW) by 2029/30, when compared to 2025/26 levels

- A similar trend is expected with NHH tariffs – they initially drop in 2026/27 before rising to a 22% (0.08p/kWh) increase in 2029/30, assessed against 2025/26 levels

The current tariffs indicate that the HH/NHH locational tariffs will fluctuate year-on-year due to locational HH/NHH revenue recovery fluctuating – as we show in the following graph.

Several uncertainties exist around the longer-term forecasts, including:

- Ofgem is yet to finalise the allowed revenues under the RIIO-3 price control (April 2026 to March 2031), presenting significant uncertainty in the revenues to be recovered. Within the five-year view, the ESO presents analysis on the impact of additional revenues on the average residual a site is exposed to. It estimates that a £500m increase or decrease would drive an approximate increase or decrease respectively of £15/year to the average TNUoS residual.

- Potential variation to the expansion constant, which could enhance or dampen the locational signal in charges. An increase to the expansion constant would result in higher HH and NHH locational demand charges in the south of England and Wales. The greatest increase would occur in the far south of the country. A reduction in the expansion constant would reduce these charges.

- Other variables include:

- Inputs to the charging model including demand, number of customers (especially large sites)

- The outcome of the TNUoS charging review

- The outcome of the Review of Electricity Market Arrangements, and the concurrent strategic review of TNUoS, although this could impact from 2030 and beyond

The NGESO will publish its next quarterly updated forecast of 2025/26 tariffs in July.

*Note: this is an updated version of an earlier article published on the initial TNUoS Five Year View, published 30 April 2024.

Please also note that since 1 October 2024, NGESO is now the National Energy System Operator (NESO).

Disclaimer

We’ve used all reasonable efforts to ensure that the content in this article is accurate, current, and complete at the date of publication. However, we make no express or implied representations or warranties regarding its accuracy, currency or completeness. We cannot accept any responsibility (to the extent permitted by law) for any loss arising directly or indirectly from the use of any content in this article, or any action taken in relying upon it.