T-4 Capacity Market auction for 2027-28 sets new record

Another year of record prices highlights tight capacity margins in the rear half of the decade.

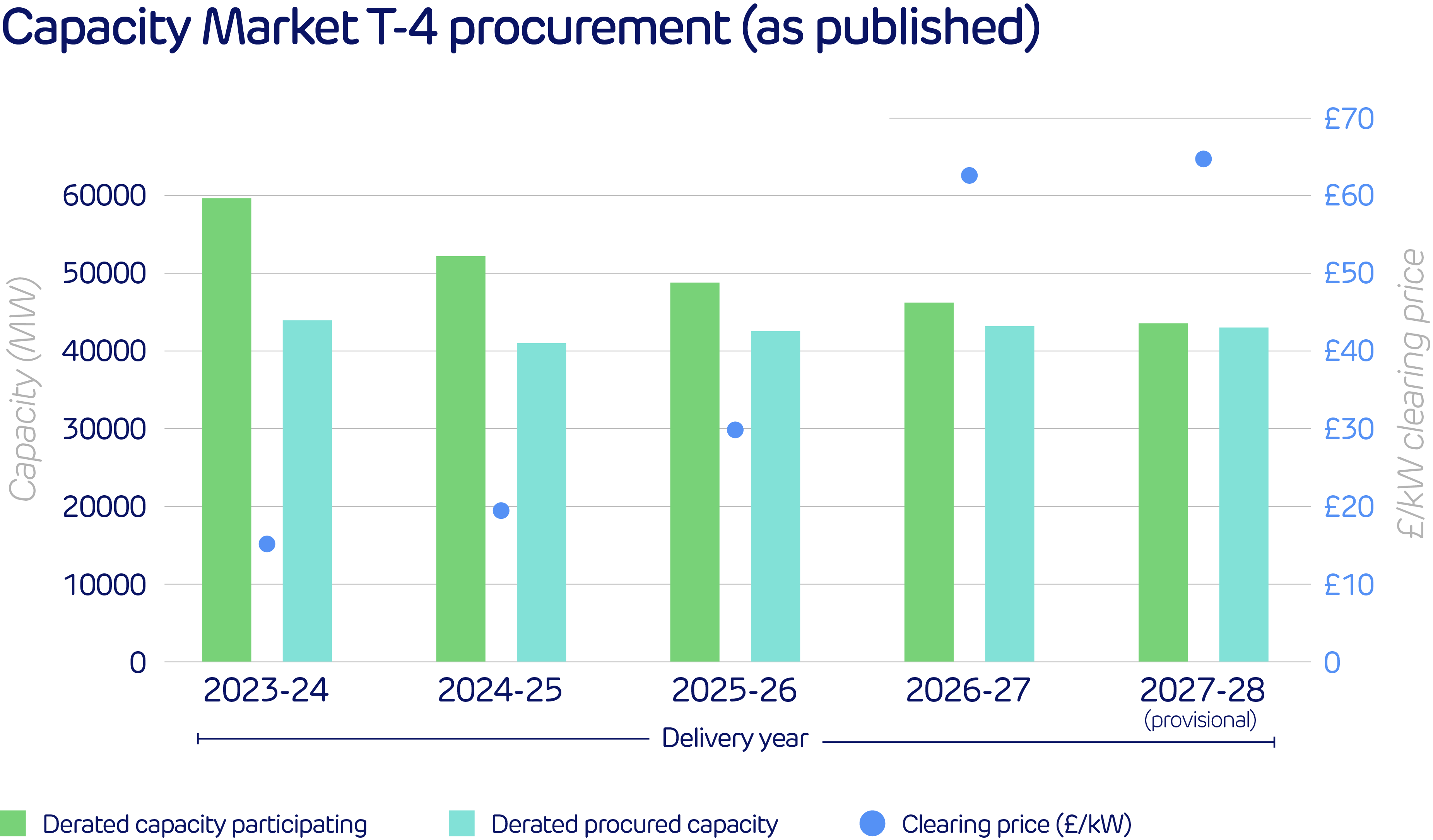

The Electricity Market Reform (EMR) Delivery Body published the provisional results for the T-4 Capacity Market (CM) auction for delivery year 2027-28 on 27 February. The auction cleared at £65/kW, the highest clearing price for a T-4 auction on record. This means the total annual cost of support from October 2027 to September 2028 is £3.6bn. This is in 2023 real prices and assumes all capacity contracts are signed.

The result supplants the previous T-4 record set last year (for delivery year 2026-27). That cleared at £63/kW and boosted the total cost of CM support to £3.4bn for the year, more than doubling the clearing price of the previous T-4 (£30.59/kW). That figure was very nearly equal to the aggregate total annual cost of the previous three T-4 auctions combined.

So, given the clear trend of increasing costs to be recovered from energy bills, what’s going on?

The chart above explores the derated capacity participating and procured in each auction, alongside the published clearing price. We can see the T-4 for the 2023-24 delivery year had over 15GW of capacity that took part in the auction but ended up not being awarded an agreement. For the T-4 for delivery year 2026-27, the level of unawarded capacity had fallen to 3GW and, in the 2027-28 auction, was only 0.5GW. While it’s true that the auction procurement targets fluctuate slightly year-on-year, we can see that the fall is predominantly due to a dwindling level of capacity entering the auction. And it’s clear that, as the supply and demand balance tightens, prices under the auction increase dramatically.

Published on 27 February 2024, independent analysis by Public First, called Mind the gap: Exploring Britain’s energy crunch, suggests this trend will continue to almost the end of the decade. Commissioned by Drax Group, the research suggests that the UK’s demand for power is – by 2028 – set to exceed dispatchable and baseload capacity by 7.5GW at peak times. Public First believes this is due to an increase in demand, the retirement of existing assets, and delays to the delivery of Hinkley Point C.

The environment for Capacity Market prices post-2028 is likely to depend on a range of factors. These include the changing demand landscape as consumers electrify and the commissioning of assets in development (e.g. Hinkley Point C).

So what does this all mean for energy costs? The CM total for delivery year 2024-25 is expected to be £1.3bn in 2023 money including both T-4 auctions and the T-1 auction. Before the T-1, costs in 2025 increase to £1.7bn, and then in 2026 and 2027 rise to £3.4 and £3.6bn respectively. So users should anticipate substantial growth in CM costs between delivery years 2024-25 and 2025-26, and again between 2025-26 and 2026-27. By 2026-27, we anticipate CM costs will rise by more than 150% compared to the charge for delivery year 2024-25. Remember this will be influenced by changes to demand and outturn costs from T-1 auctions.

For more information on our Third Party Costs (TPCs) forecasts, look out for our upcoming Spring TPCs Guide, released on 25 March.