A sizzling summer of energy announcements

Since the Labour Party won the 2024 general election, it’s made multiple policy and regulatory statements in support of its Clean Power 2030 pledge. After creating GB Energy and publishing the Clean Power 2030 Action Plan in late 2024, it recently made more announcements – as summarised below.

Cheaper power for energy intensives and advanced manufacturing

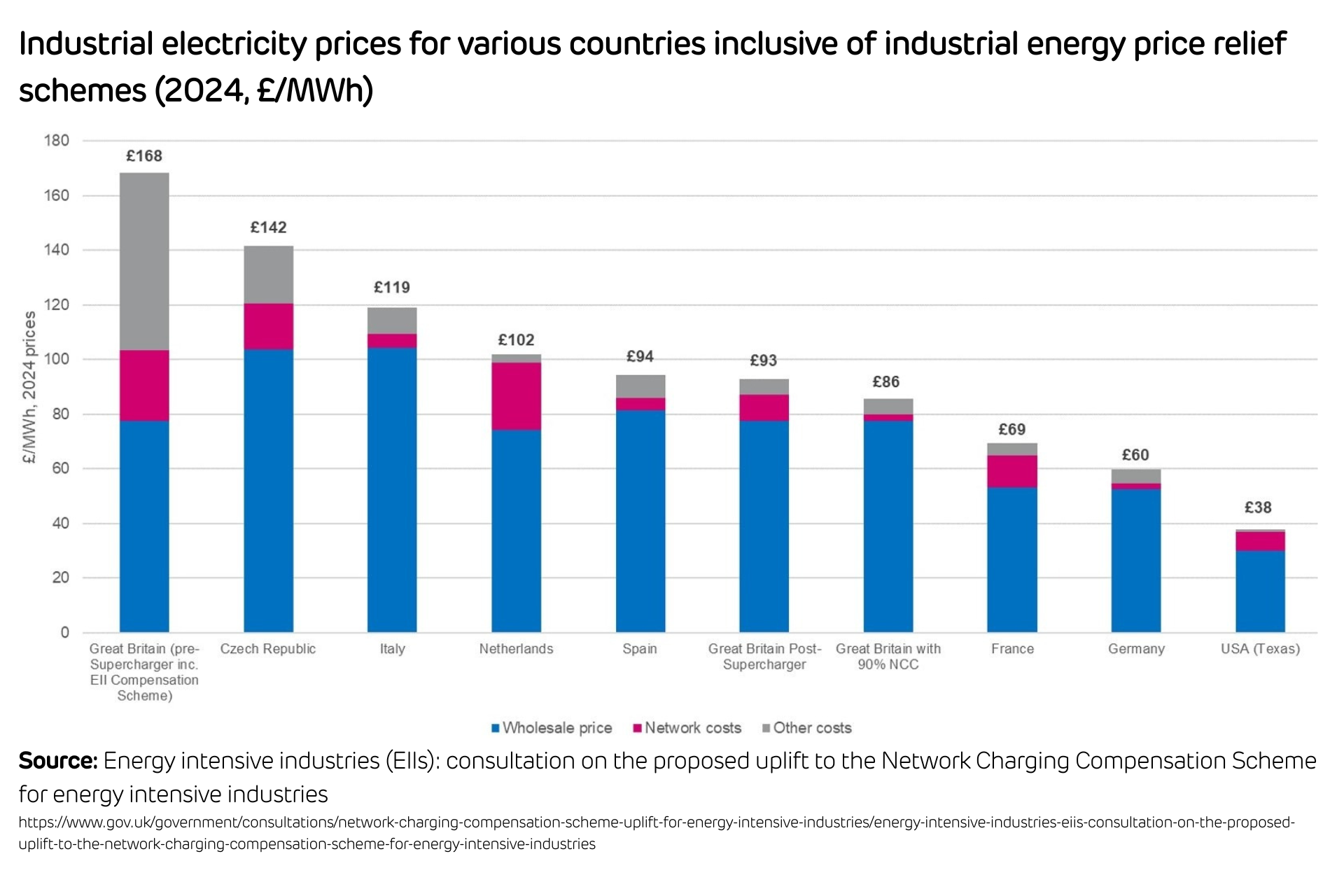

GB-based Energy Intensive Industries (EIIs) face higher power costs than those in comparative countries across Europe – as well as amongst other developed and rapidly decarbonising countries. This is a key strategic challenge for the UK Government.

Source: DESNZ/ DBT/ Baringa analysis

In June, the Government announced its Modern Industrial Strategy, which included:

- Enhanced EII network charging rebates, increasing the discount from 60% to 90% with effect from 2026, and funded by “bearing down on costs in the energy system”. The consultation also proposed to increase the application window for EIIs to provide evidence from one to two months. The Government opened a follow-up consultation on 18 July.

- A new British Industrial Competitiveness Scheme (BICS), coming into effect from 2027. Eligible businesses will be exempt from Renewables Obligation (RO), Feed-in Tariff (FiT) and Capacity Market (CM) charges, reducing their electricity costs by an estimated £35-40/MWh.

The BICS will benefit manufacturing electricity intensive frontier industries in the IS-8, such as automotive and aerospace, and foundational manufacturing industries in the supply chains, such as chemicals. Eligibility will be determined shortly following consultation and reviewed in 2030.

The Government will also consult on how the corporate power purchase agreement (CPPA) market can be developed and improved for industry, including learning from international experience. Finally, a new Connections Accelerator Service will provide support for demand connections, to begin operation from the end of 2025.

Zonal/national debate concludes

On 10 July, the Government confirmed it wouldn’t proceed with zonal pricing reforms to the wholesale electricity market proposed under its Review of the Electricity Market Arrangements (REMA). Instead, it will retain a single GB-wide wholesale price.

The Government believes it can solve the current misalignment between generation-siting and transmission-build – causing higher constraint and balancing costs – without moving to a more disruptive zonal pricing model. It said the decision would provide certainty for investors, fairness for customers, and lower costs by reducing the risk of investing.

The Strategic Spatial Energy Plan (SSEP), which the National Energy System Operation (NESO) will publish next year, will be the centrepiece of the reforms. This will both use and be influenced by several delivery levers: planning reform, seabed leasing, network build under the Centralised Strategic Network Plan (CSNP) and reforms to connections and network charging.

On network charging reform, the Government will work with Ofgem to provide stronger incentives for investors to build generation where it’s needed. This work will also ensure Transmission Network Use of System (TNUoS) charges are more predictable for investors. This is a key measure that, alongside the SSEP, will help drive locational outcomes as part of the reforms. DESNZ said this will provide a clearer upfront signal of the relative system value of investing in different locations.

Network charging reform

The Government aims to deliver Transmission Network Use of System (TNUoS) reform within this parliament, and by 2029 at the latest. To support this, Ofgem published an open letter on 21 July laying out its initial thinking on reforming charging signals.

Ofgem aims to reduce constraint costs by incentivising generation assets to choose a location based on planned network spare capacity. The regulator also sees merit in encouraging demand and storage investment in specific locations by using premiums or discounts on connection and TNUoS charges to drive specific outcomes. For instance, incentivising electrolysers to site in Scotland to convert excess power into hydrogen.

In addition, Ofgem wants to improve the likelihood of investment by making network charges more predictable. It highlights that TNUoS charges could be fixed for an extended period, potentially over the lifetime of assets.

Ofgem will lead on the development of the reforms once the Government has outlined in more detail its Reformed National Pricing Delivery Plan (expected later this year).

RIIO-ET3 Draft Determinations suggest high TNUoS

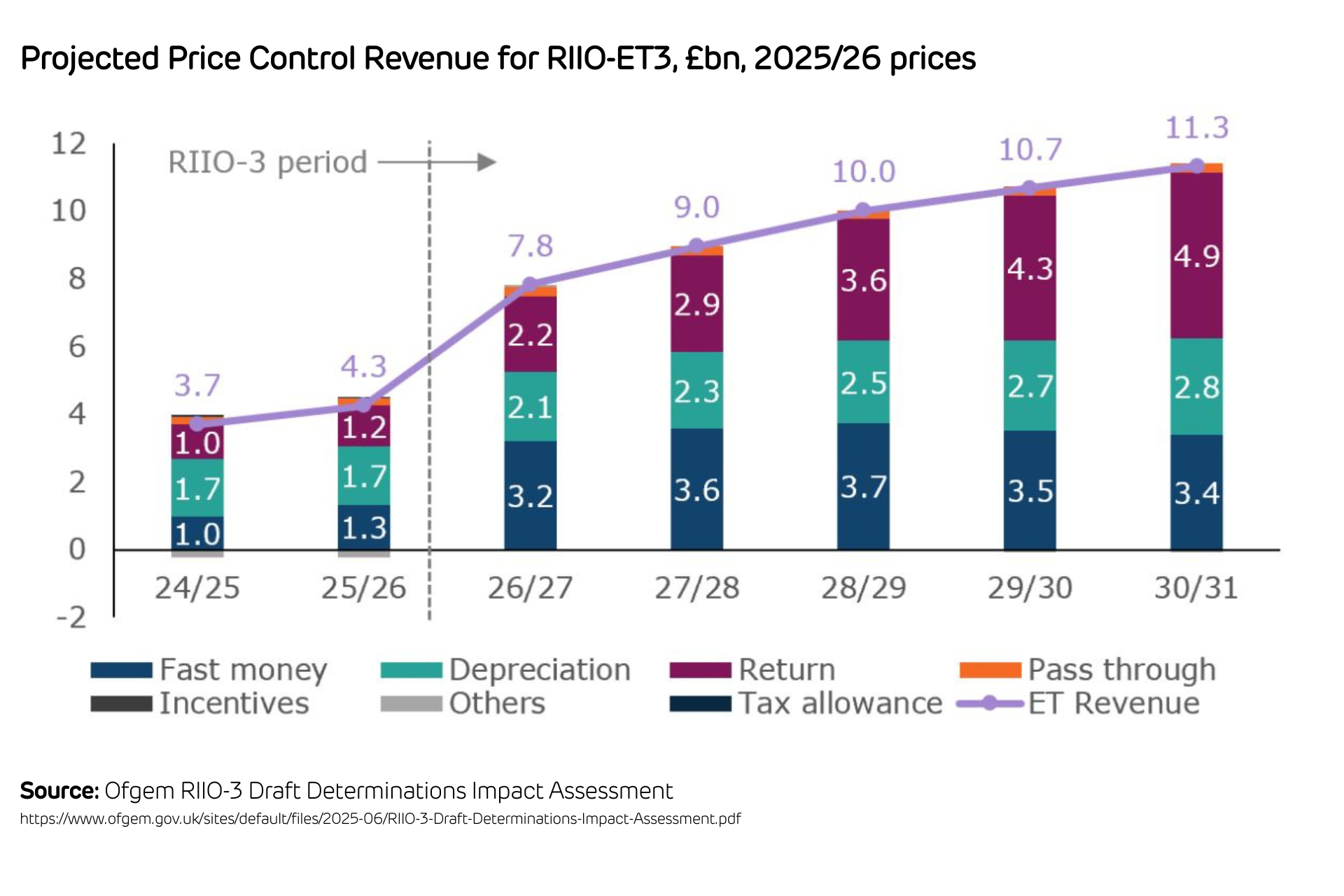

On 1 July, Ofgem published its Draft Determinations (DDs) for electricity Transmission Owners (TOs) over the RIIO3 period (1 April 2026 to 31 March 2031). This is important because the resulting allowed revenues form a key part of TNUoS charges – as increased standing charges – for final consumers.

The DD figures suggest that the allowed revenues for TOs in 2026-27 are 82% higher than those in 2025-26 (without adjusting for inflation). They’re also 50% higher (once adjusted for inflation) than NESO suggested in its Initial View of Draft Tariffs for 2026-27. This forward view already predicted an average 25% increase to standing charges across consumers, and the DD is due to add a substantial further uplift to charges in 2026-27. The figures below are from Ofgem’s impact assessment.

Source: Ofgem Draft Determinations Impact Assessment

The final allowed revenues for TOs will only be set following Ofgem’s Final Determination due later this year.

More updates

The Government announced a Final Investment Decision for Sizewell C on 22 July. At the time of writing, industry awaits more information on the Regulated Asset Base (RAB) levy that will be recovered through energy bills.

The Government also consulted in July on a range of reforms to the next Contracts for Difference (CfD) Allocation Round 7 (AR7), due to open for applications in August 2025. The proposed reforms included allowing fixed bottom offshore wind to enter the auction without planning approval, and publishing the budget ahead of the auction. In addition, the Government proposed increasing the duration of CfD support from 15 to 20 years for fixed-bottom offshore wind, floating offshore wind, onshore wind and solar.

These new announcements could have an impact on your energy bill, how you procure energy, and your perception of risk. As a consultative decarbonisation partner for our customers, Drax Energy Solutions is keen to continue analysing the latest developments and offering insights.

Disclaimer

We’ve used all reasonable efforts to ensure that the content in this article is accurate, current, and complete at the date of publication. However, we make no express or implied representations or warranties regarding its accuracy, currency or completeness. We cannot accept any responsibility (to the extent permitted by law) for any loss arising directly or indirectly from the use of any content in this article, or any action taken in relying upon it.

Subscribe to our newsletter

Sign up to our monthly newsletter and get the best of Drax Insights sent directly to your inbox.